FICO® Debt Manager™

Overall

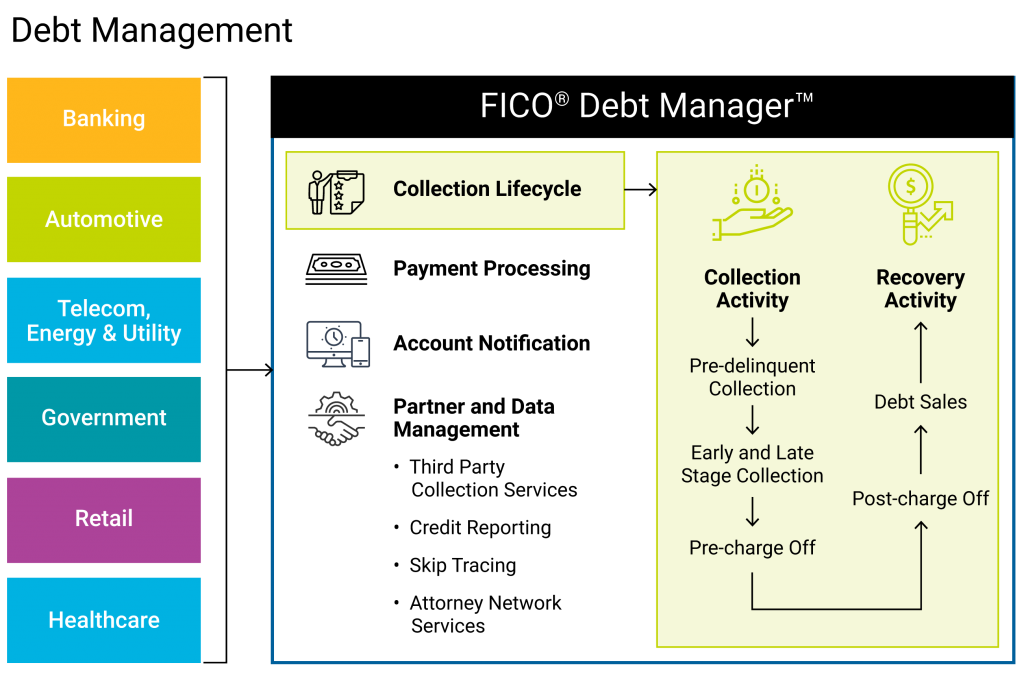

Debt Manager is a complete accounts receivable management solution for maximizing returns, controlling costs and delivering strong customer engagement. It is designed to address today’s complex economic and regulatory requirements and is configurable with many business requirements, including collections, recovery, debt sale, vendor management, bankruptcy, repossession and asset remarketing. In the debt collection industry, revenue growth is expected to remain flat while consumer debt continues to grow, due to increased regulation and difficulties collecting debt. Debt Manager remains fully compliant and works with its users to meet their unique business needs.

Solution: Verticals & Use Cases

Debt Manager serves financial institutions, government collections, and third-parties, including collection agencies. Adopting Debt Manager can reduce spending on wages and increase margins. Debt Manager produces measurable improvements in collection revenue, operating costs and consumer responsiveness for organizations in banking, government, auto lending, collection agency, retail, student loan, health care, telecom and utility.

Product Overview

Debt Manager is designed so business requirements are met through configuration, rather than requiring code customizations. This ensures that data remains accessible and comprehensible. Debt Manager features modern architecture, supports the entire credit lifecycle, includes FICO Collection Scores out-of-the-box, and offers configuration instead of customization.